- Conscious Supply Chain

- Posts

- Omnichannel CPG: Why does Cashflow Planning only work after Supply Optimization

Omnichannel CPG: Why does Cashflow Planning only work after Supply Optimization

& why it's hard but important.

Your cash-flow “forecast” is really just a half-blind guess because it isn’t tied to a supply-optimised purchase plan.

Until you know exactly what you’ll have to buy, when you’ll buy it, and how you’ll pay for it, every projection you send to your board is fiction wrapped in nice formatting.

Obviously it’s not easy to find out – but let’s really think through how we can make it as accurate as possible.

What do we need to make sure before cashflow is set-up correctly?

Create your demand plan including future sales channel & SKU

Now understand what are the needed purchase orders for the next 12-18 months

After you understand quantity, timing and for which supplier you need to buy your products

We’ll this is really hard to solve in a spreadsheet actually. You probably know.

Hence you can use Spherecast for this:

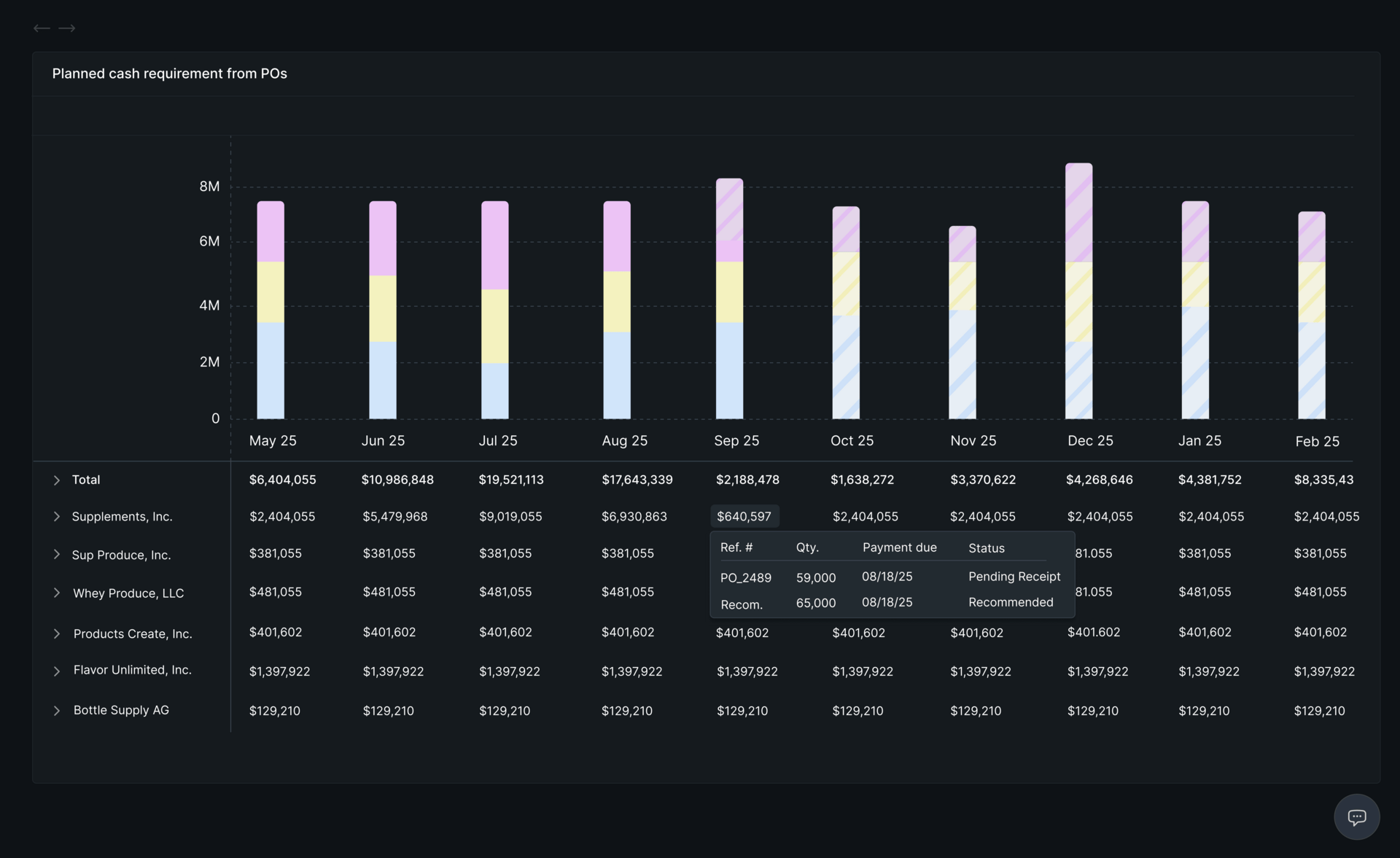

Every future cash-outflow from your POs - Placed or Recommended

What can you see here?

In this view you can see the future outflow based on future POs. We can also drill-down into any expense into the future, per supplier, and can directly deep-dive into the particular purchase order.

Now for financial planning - you exactly know what the required $ expense is to maximize your $ revenue.

What happened here

Spherecast automatically took your demand plan

Spherecast built the perfect purchase order plan considering all constraints

…including, dynamic safety stock, best-before requirements, current expiration risk, multiple warehouses and their relationship, and costs

We took in payment terms of the comans and suppliers

We built the cashflow plan

Bonus: Send that purchase order plan to your coman and negotiate a discount. The more you can commit before - the better the coman can plan his production.

Why does it help?

12-month clarity: Forecasts + payment terms expose future cash gaps early, so you can secure credit before they sting.

Demand → supply → dollars: Link demand plans to lead-times to know exactly when cash leaves the bank.

Supplier muscle: A firm, time-stamped buy-schedule wins better prices, longer terms, and priority slots.

Single source of truth: Finance and ops see the same timeline. Faster decisions, no finger-pointing.

One learning you should take out here:

Next time you sit in front of the cashflow forecast - ask yourself - is it supply optimized already?

See you soon!

-Leon